GTA HOME PRICES INCREASE 3.5%

December 19, 2018 Real Estate

Home prices continue their upward trend as average prices rose 3.5% in November 2018 compared to November 2017.

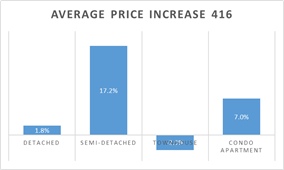

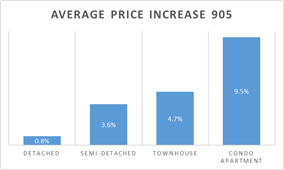

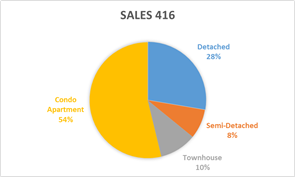

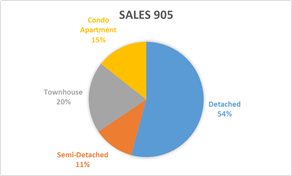

This was driven by the condo and semi-detached segments which increased by 7.5% and 8.3%, respectively. The detached market grew by a more modest 1.3%. This growth varies between the 416 and 905. Growth in prices were driven by the semi-detached and condo markets in the 416 while growth in prices were driven by semi-detached, townhomes and condos in the 905.

|

|

Due to the relative affordability, the greatest number of transactions are for condos in the 416. Also for relative affordability, home purchasers for detached are choosing to move to 905 in relatively larger numbers.

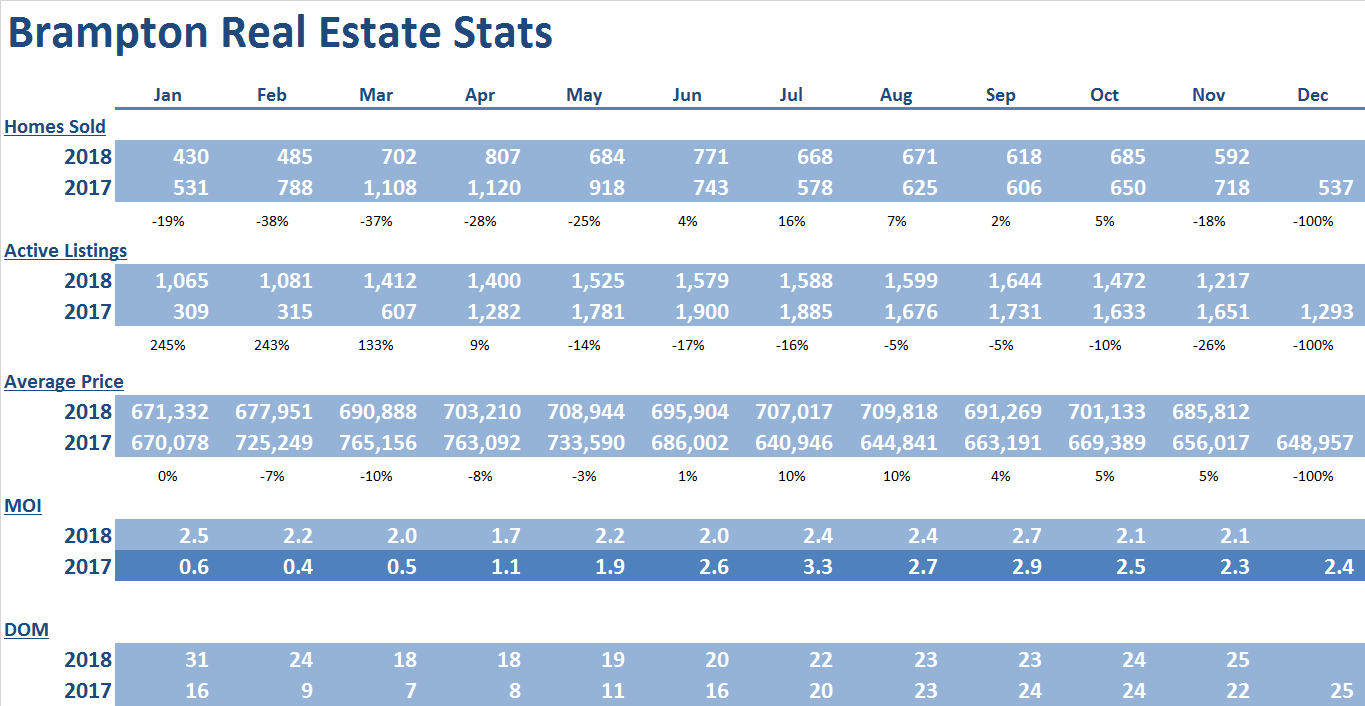

Year-to-date sales in Brampton are only 15% lower than 2017, as sales increases for the past five months have significantly offset the decreases experienced during the beginning of the year (note: during February and March of 2018, Brampton experienced unit sales decreases of 38% and 37% year-over-year, respectively).

|

|

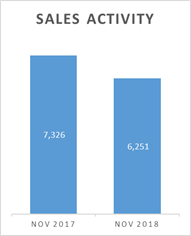

Sales activity for the second half of the year has grown in every month except for November as November 2017 had an artificial bump due to the looming OSFI-mandated stress test at the end of last year. As a result sales activity fell by 14.7% in November 2018 compared to November 2017.

Supply remains tight at approximately 2.6 months of inventory, resulting in 3.5% price increase mentioned above (industry insiders view anything under 4 months as tight supply and a sellers’ market, 4 to 6 months as balanced market and above 6 as a sellers’ market). In fact, prices have been higher year over year for the sixth consecutive month.

Many Torontonians have come to the realization that waiting any longer will create a two-pronged challenge – increasing home prices and increasing borrowing costs. The Bank of Canada (BOC) increased interest rates by a quarter point five times since July 12, 2017 and more increases are expected in 2019. As a result, and rightfully so, many understand that now is the time to buy.

The key factors leading to the increasing prices continues to be the combination of strong employment rate, historically low interest rates, and strong population growth*.

Brampton

November was the 6th consecutive month with year-over-year price increases and there have been 8 monthly price increase since December of 2017. Prices have risen 6% since the end of 2017. Prices in November 2018 rose 5% compared to November of 2017 to $685,812. This was driven by strong increases across all housing types. The October 2018 average price is down by only 10% from the all-time high set in March of 2017.

Supply remains consistent with October at a very tight 2.1 months of inventory on hand. This tight supply will continue to create upward pressure on average prices moving forward.

Days on market have remained low at 25, which represents a significant improvement from the beginning of the year, when days on market reached 31.

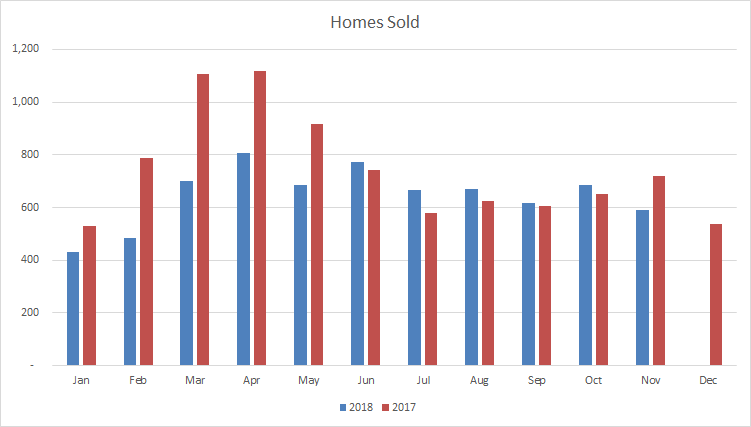

November represents the first month of the second half of the year where sales activity fell compared to the previous year as November 2017 had an artificial bump due to the looming OSFI-mandated stress test at the end of last year. As a result, sales activity fell by 18% in November 2018 compared to November 2017.

Year-to-date sales in Brampton are only 15% lower than 2017, as sales increases for the past five months have significantly offset the decreases experienced during the beginning of the year (note: during February and March of 2018, Brampton experienced unit sales decreases of 38% and 37% year-over-year, respectively).

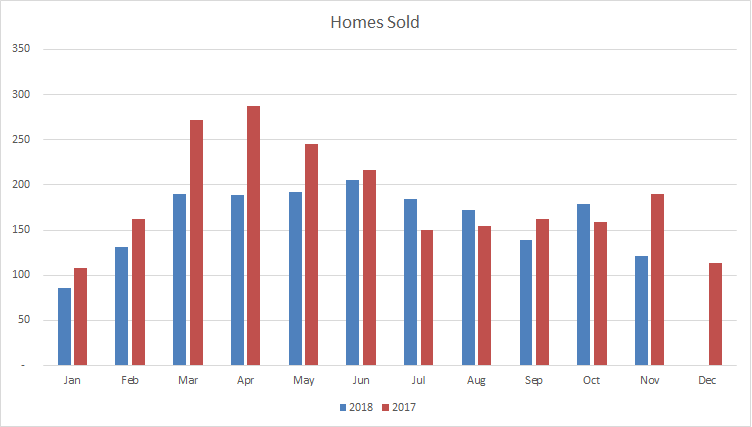

|

|

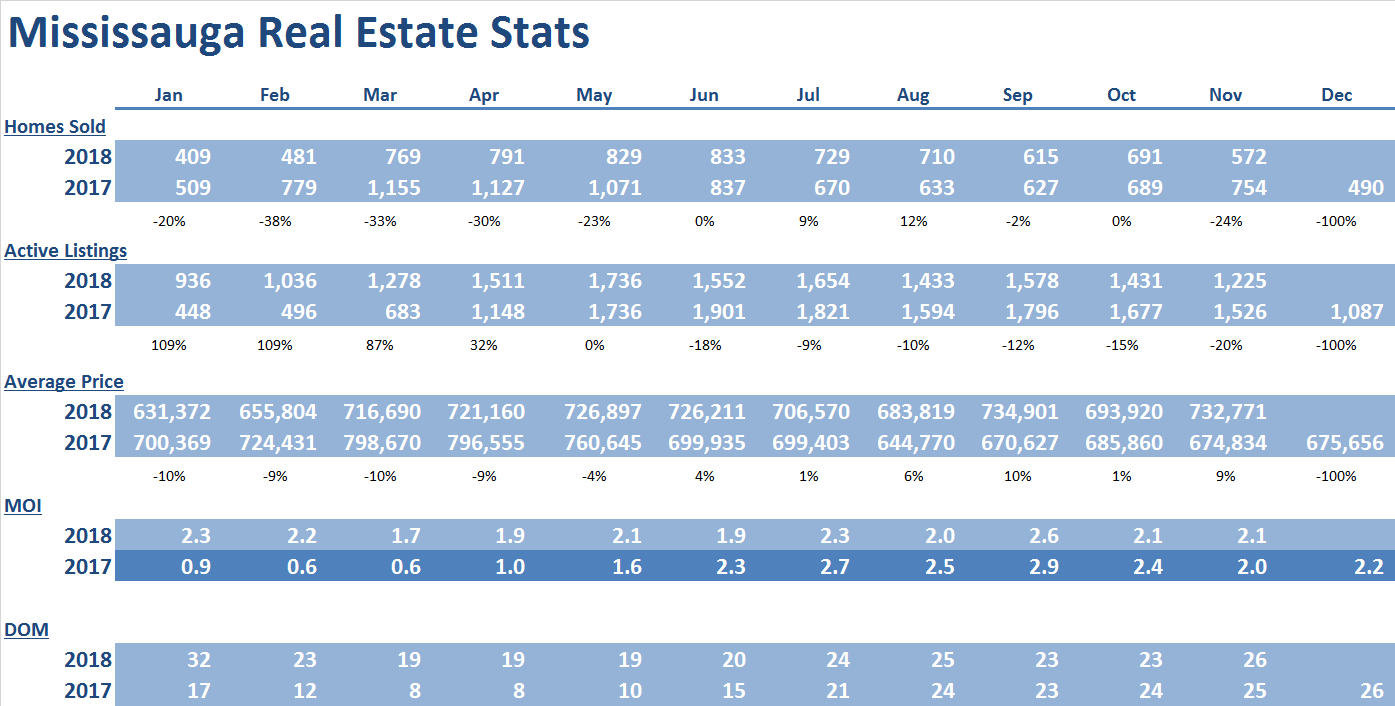

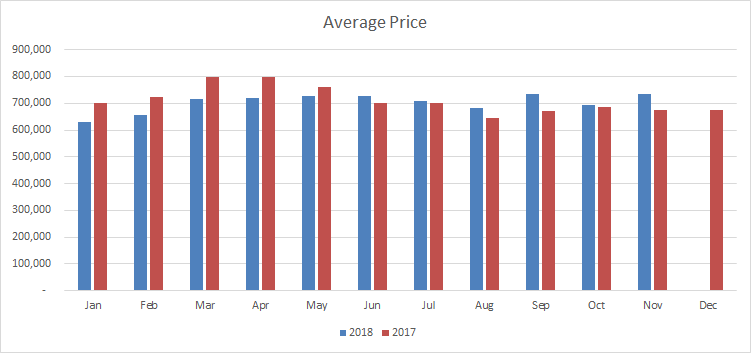

Mississauga

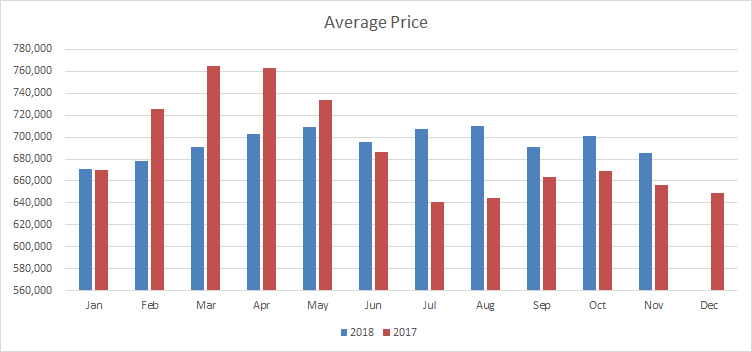

November was the sixth consecutive month of the year-over-year prices increases and prices have been up for 6 of the past 10 months since December of 2017. Prices have risen 8% since the end of 2017. Prices in November 2018 rose 9% to $732,771 compared to November of 2017.

The November 2018 average price is down by only 8% from the all-time high set in March of 2017.

Supply remains very tight at 2.1 months of inventory on hand at the end of November. This supply constraint will continue to create upward pressure on average price moving forward.

Days on market increased slightly to 26 for the month, represents a significant improvement from the 32 days on market experienced earlier in the year.

Although number of homes sold have been either higher or relatively the same for each month of the second half of the year, there was a significant drop (24%) in number of home sales for November 2018 compared to November 2017 as November 2017 had an artificial bump due to the looming OSFI-mandated stress test at the end of last year.

|

|

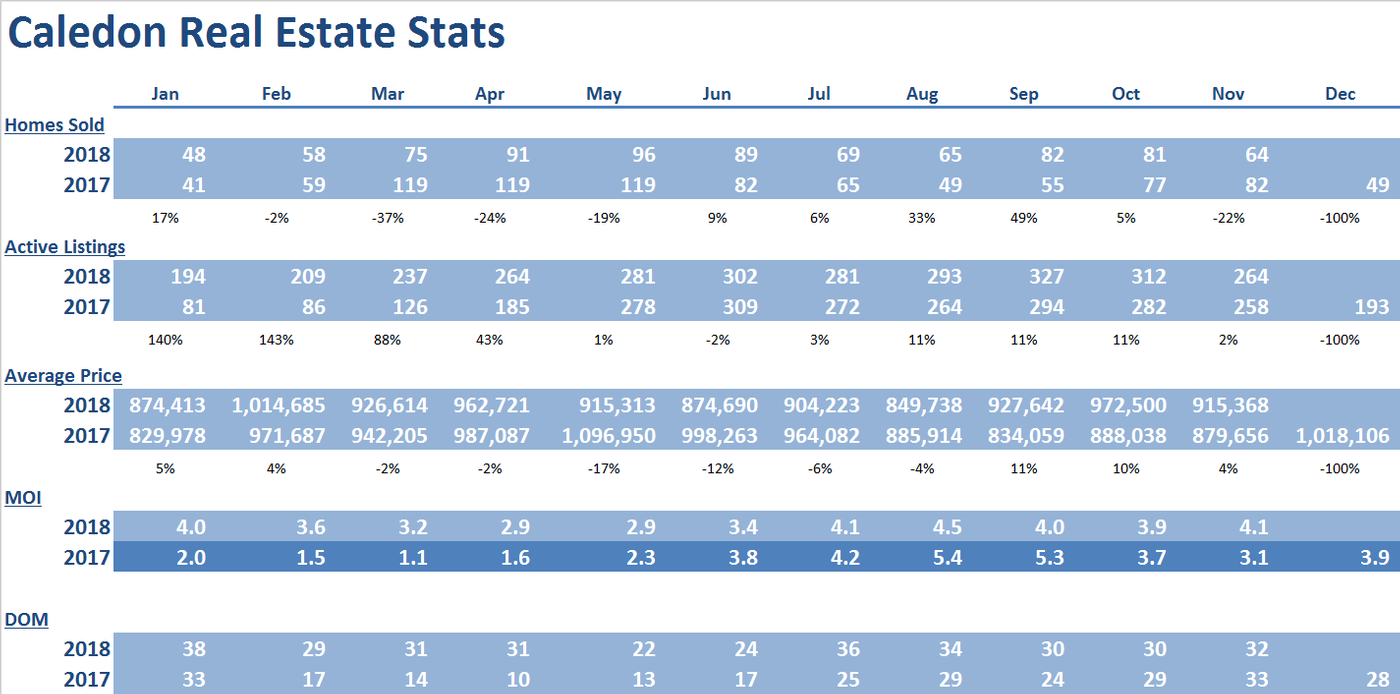

Caledon

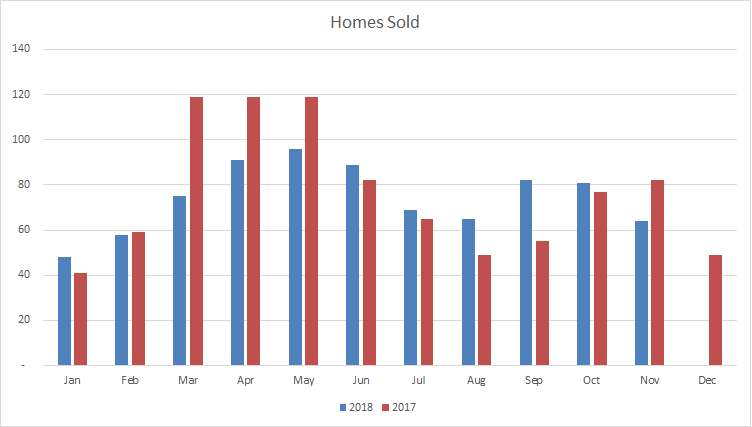

Year over year sales increased for five of the past six months. As a result of the surge in sales activity during the second half of the year, year-to-date sales are only down 6% from 2017.

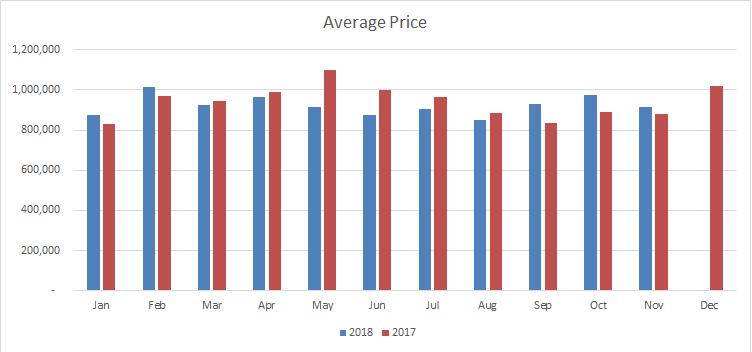

The average price in November of $915,368 is up 4% from November of 2017.

Supply eased slightly to 4.1 months of inventory on hand and thus is in balanced market territory which should result in low to mid-single digit price increases moving forward.

Days on market increased to 32 days and has improved dramatically from the beginning of the year when days on market was 38.

|

|

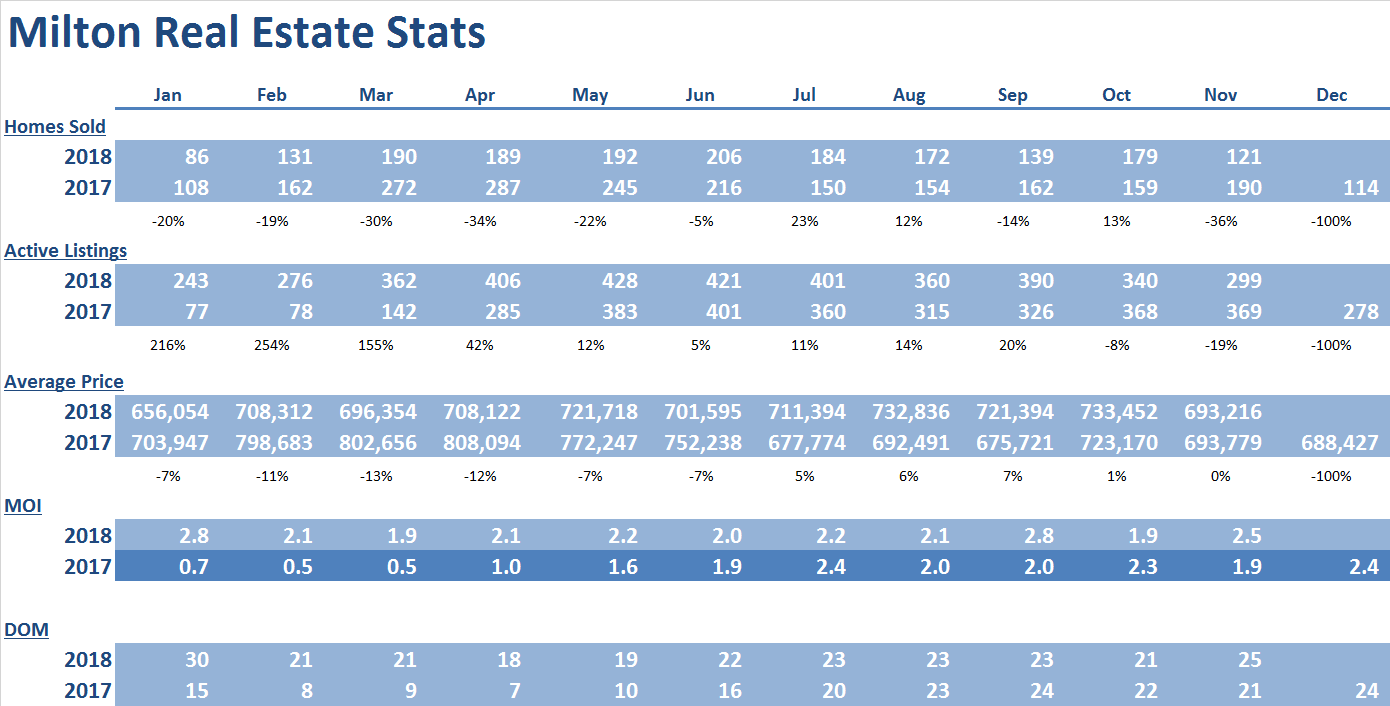

Milton

Prices in November 2018 remained consistent with November of 2017 at approximately $619k. Prices are up a modest $5k from the end of 2017.

Although supply eased up to 2.5 months of inventory, it still remains tight and thus should create upward pressure on average prices moving forward.

Days on market eased to 25 which represents an improvement from the beginning of the year, when days on market reached 30.

Year-to-date sales in Milton are only 15% lower than 2017, as sales increased 3 of the past five months, offsetting the decreases experienced during the beginning of the year (note: during March and April of 2018, Milton experienced unit sales decreases of 30% and 34% year-over-year, respectively).

|

|

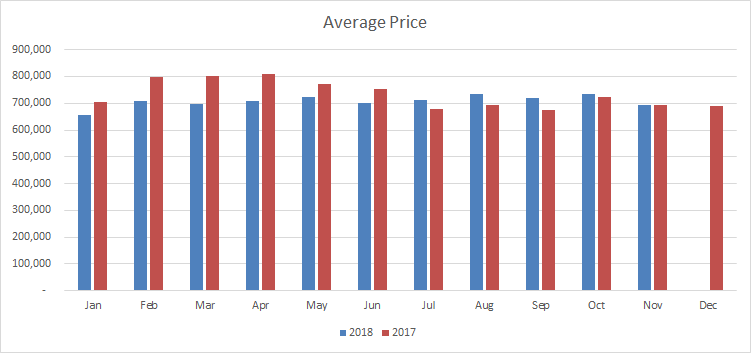

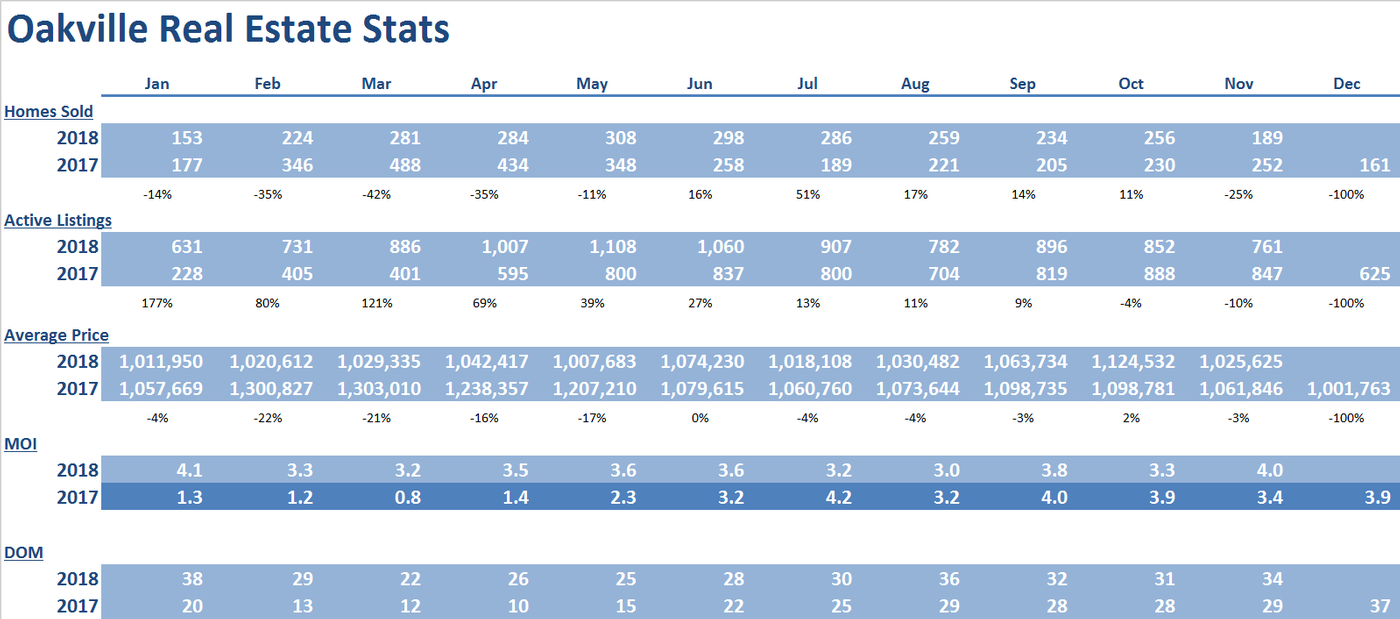

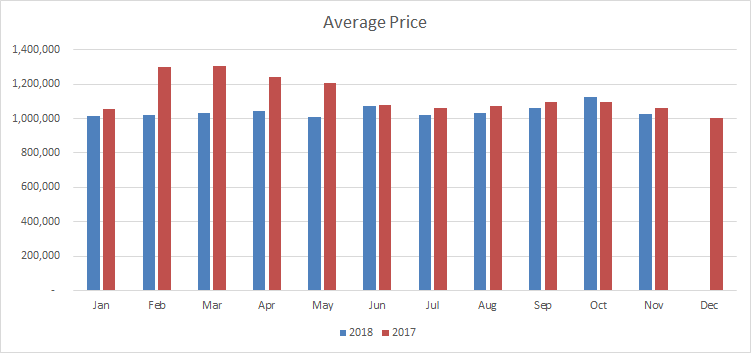

Oakville

Year over year sales increased for five of the past 6 months, making up for significant reductions in year over years sales transactions experienced at the beginning of the year. As a result, sales year to date are only down 12% from 2017.

Average price of $1,025,625 is down slightly (3%) from November of 2017, but is up slightly (2%) from the end of the year.

Supply eased up slightly to 4.0 months of inventory on hand and is in balanced territory and as a result prices should increase a modest low to mid-single digits moving forward.

Days on market increased to 34, which represents a slight improvement from the beginning of the year, when days on market reached 38.

|

|

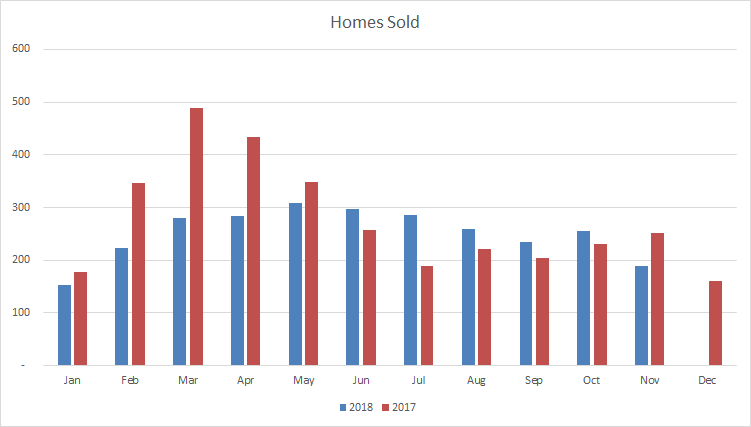

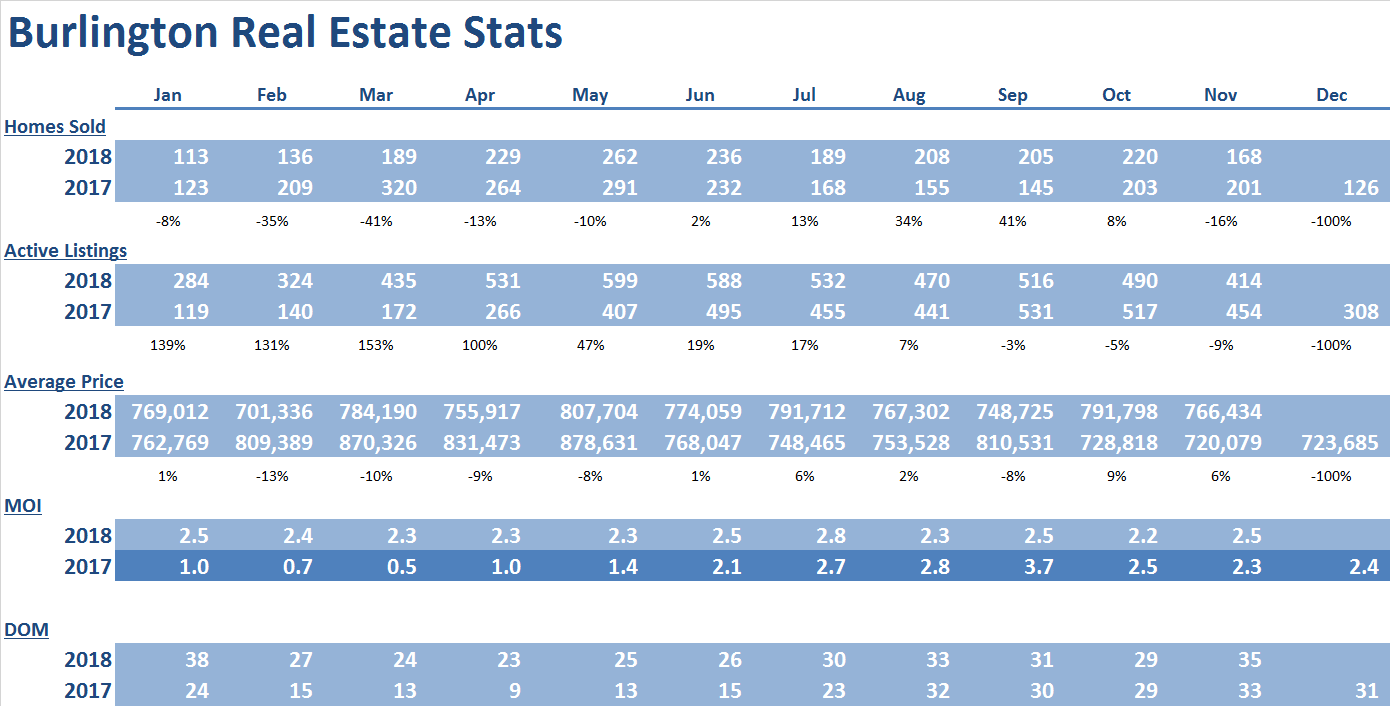

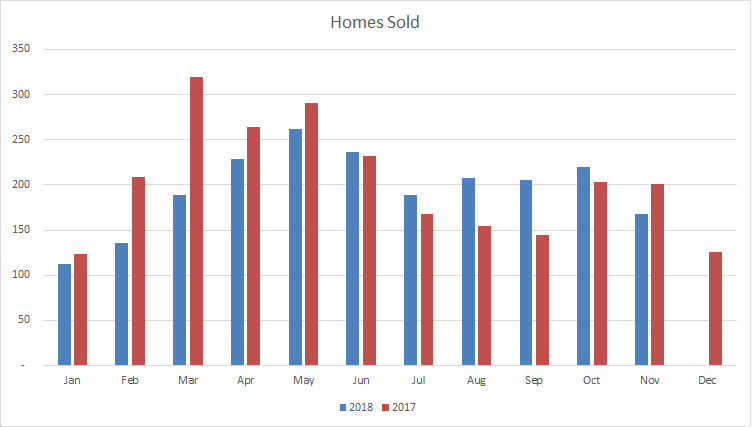

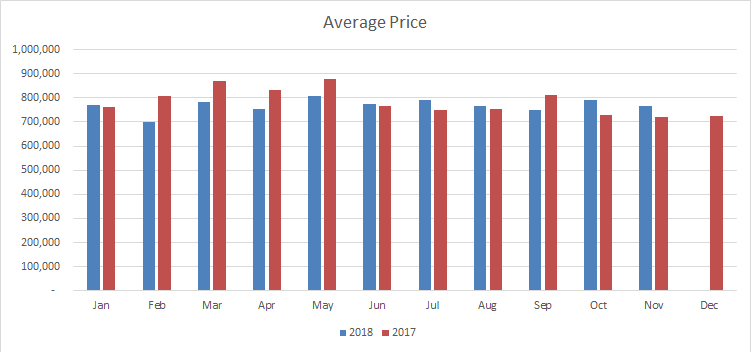

Burlington

Year over year sales increased for five of the past six months. As a result, unit sales are only 7% lower than 2017 year-to-date.

Prices have increased five of the past six months on a year-over-year basis. Prices are 6% higher than November 2017. This was driven by increases detached homes.

Supply eased slightly but remains at a tight 2.5 months of inventory on hand from 2.2 in the prior month. This tight supply should put upward pressure on prices moving forward.

Days on market have increased to 29, which represents a significant improvement from the beginning of the year, when days on market reached 38.

|

|

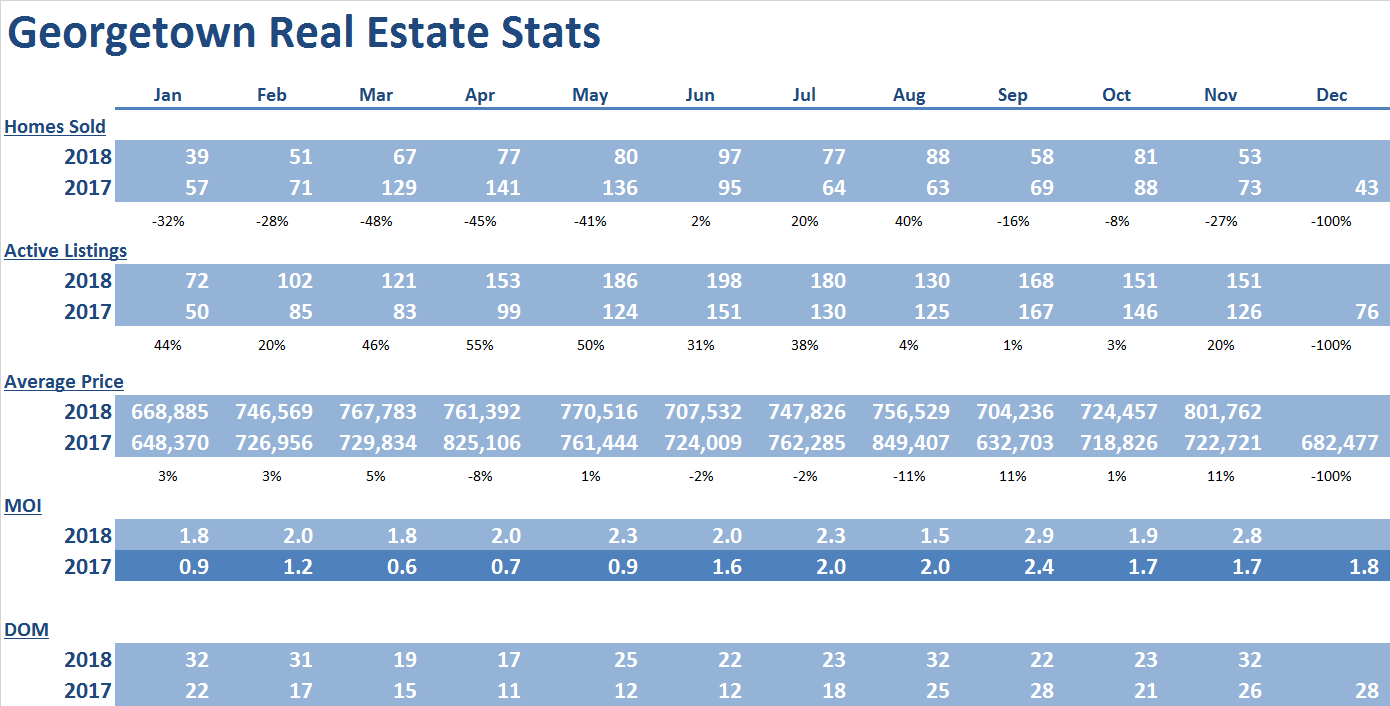

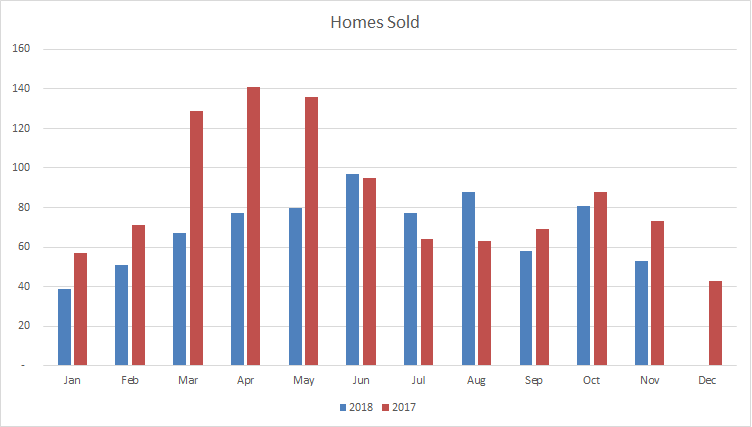

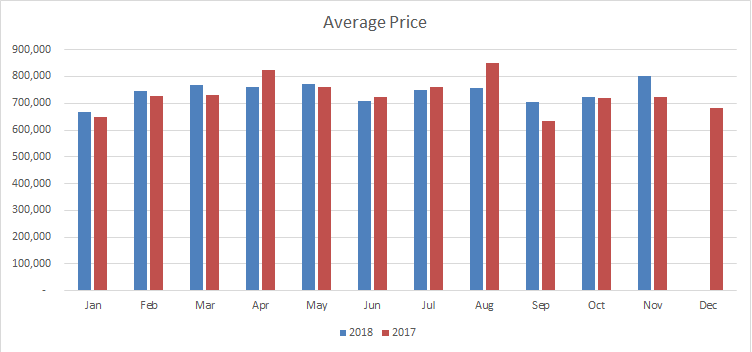

Georgetown

November average home price of $801,762 is 11% from the November of 2017.

Year over year sales increased for 3 of the past 6 months and as a result year-to-date sales are down 22% compared to 2017, which represents a dramatic improvement from the beginning of the year when year-over-year sales were down as much as 48% (February).

Supply increased to 2.8 months of inventory (MOI) on hand. MOI of under 4 represents a tightly supplied market and this should continue to put upward pressure on prices moving forward.

Days on market increased to 32 and remains consistent with the beginning of the year.

|

|

Conclusion

As available housing in most parts of the GTA remains in a short supply, the upward pressure on average prices will continue. This coupled with the potential for further interest rate increases in 2019 should create urgency for the prudent first-time and move up buyers.

*Some Key Economic indicators for a healthy real estate forecast:

Peel Region expected to grow by 500,000 people in next 2 decades https://www.insauga.com/500000-new-residents-expected-in-mississauga-and-surrounding-cities-over-next-two-decades

BOC raises rate Oct 24 2018 https://www.bankofcanada.ca/2018/10/fad-press-release-2018-10-24/

Key economic indicators – Statistics Canada https://www.statcan.gc.ca/eng/start

Consumer confidence index https://www.conference-board.org/data/consumerconfidence.cfm

The information contained on this site is based in whole or in part on information that is provided by members of The Canadian Real Estate Association, who are responsible for its accuracy. CREA reproduces and distributes this information as a service for its members and assumes no responsibility for its accuracy.

This website is operated by a brokerage or salesperson who is a member of The Canadian Real Estate Association.

The listing content on this website is protected by copyright and other laws, and is intended solely for the private, non-commercial use by individuals. Any other reproduction, distribution or use of the content, in whole or in part, is specifically forbidden. The prohibited uses include commercial use, "screen scraping", "database scraping", and any other activity intended to collect, store, reorganize or manipulate data on the pages produced by or displayed on this website.